Trust Registration – Benefits, Process, Documents

Indian Trust Act 1882 defines the Trust as an organization where the owner (trustor) decides to transfer the right of his property to a second person called trustee so that the third person (beneficiary) can take the benefit out of it.

What is a Trust?

Parties in a Trust – Trustor, Trustees, Beneficiary

Eligibility Criteria for Trust Registration

Process of Trust Registration

Documents Required for Trust Registration

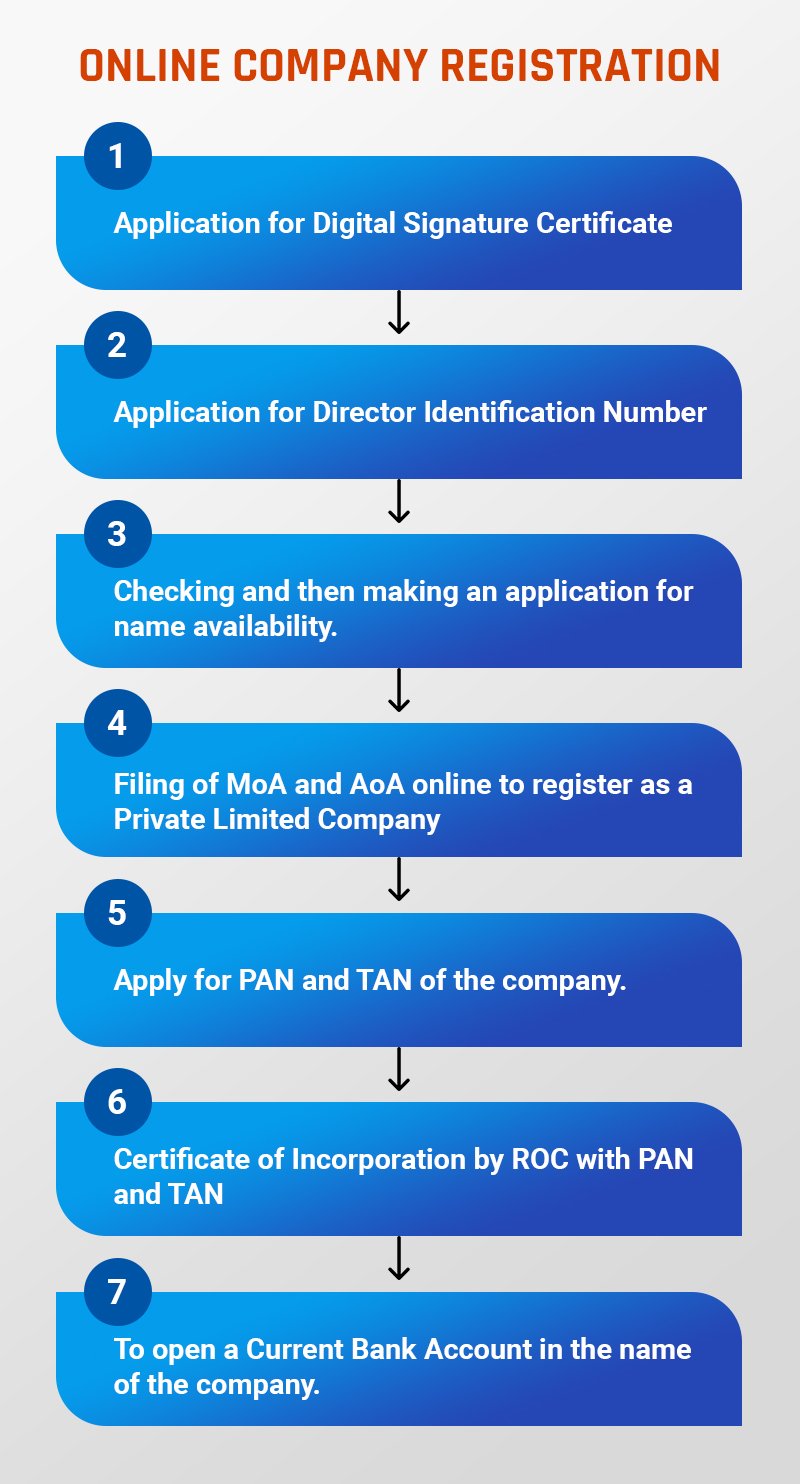

Overview of Private Limited Company Registration

A Private Limited Company is a privately maintained small business existence, which is one of the highly recommended means to start a business in India. The Companies Act 2013 governs private limited company registration in India.

While, minimum 2 shareholders are required to start a private company, while the higher limit of members are 200 as per the Companies Act, 2013. If a private limited company faces financial risk, its shareholders are not subject to sell their personal assets, i.e. they ought to have limited liability.

- A registered private limited company increases the credibility of your business. A registered private limited company increases the credibility of your business. A registered private limited company increases the credibility of your business.

- Help owners from personal liability and protects from other risks and losses.

- Draws more customers

- Ease in obtaining bank credits

- Offers limited liability to preserve your company’s assets

- Greater funds supplement and more attractive stability

- Enhance the potential to grow big and expand

Starting a private limited company offers many advantages. Some of them are as follows:

- Limited Liability

- The responsibility of the members of a private limited company is restricted to their share only as the private limited company is a separate legal entity.

- Separate Legal entity

- A private limited company is a separate legal entity which posses all the rights to sue or to be sued. It acts an artificial person which can buy a property on its own name.

| # | First | Last | Handle |

|---|---|---|---|

| 1 | Mark | Otto | @mdo |

| 2 | Jacob | Thornton | @fat |

| 3 | Larry | the Bird |

FAQs