Overview of Virtual CFO Services

With the introduction of the concept of Virtual CFO small businesses now receive support that they could not have afford previously. Virtual CFO has crafted a way for small businesses, following which they can get access to an experienced financial professional at an affordable cost. Though the services of CFO differ from firm to firm,

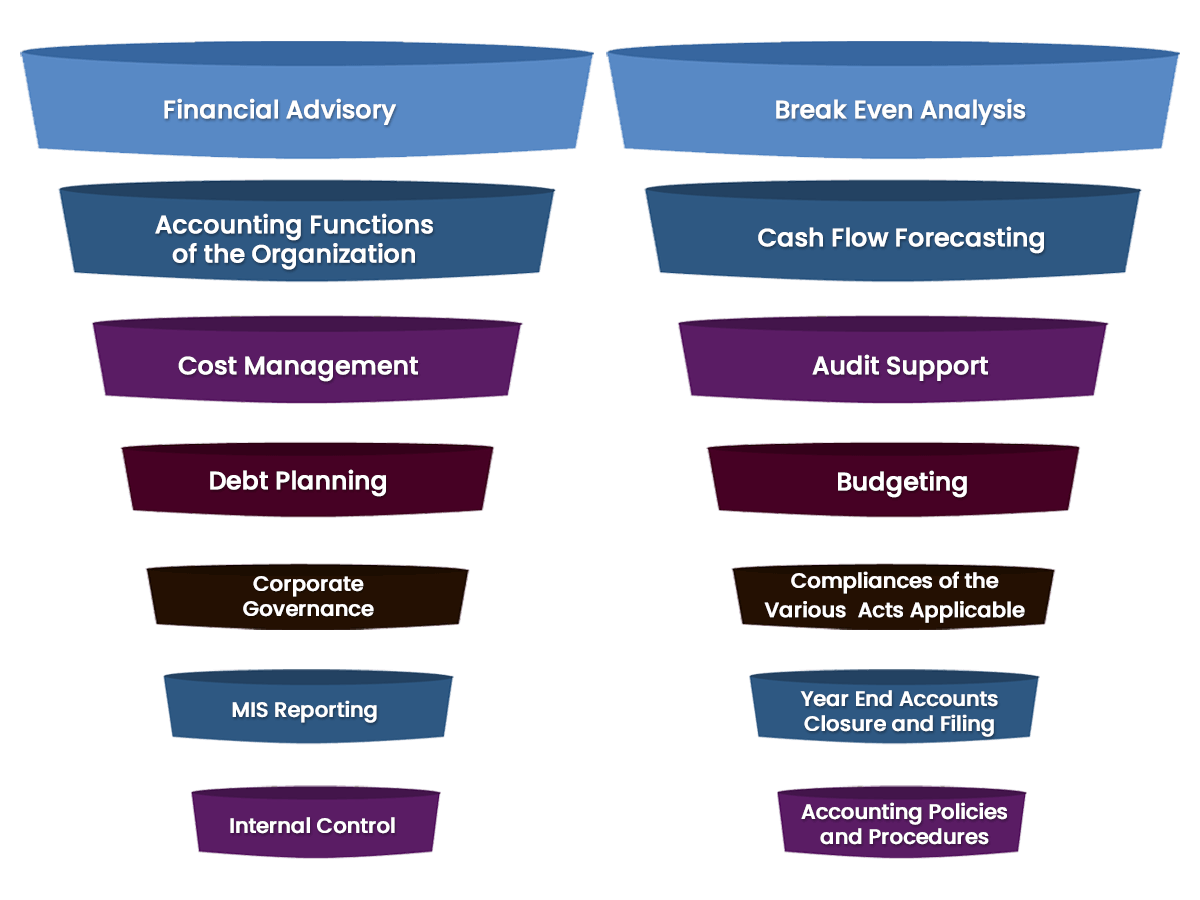

However, following services are common and often rendered to every firm who hire a Virtual CFO:

- It takes control of all the duties of a traditional CFO, but solely on a part-time basis

- Keeps an eye on the financial health of the business usually by adopting cloud technology

- Offer financial guidance and insight to the business on the matters related to finance.

- Give companies back-office functions which include managing account ledgers, depending on the client and their needs.

Often companies who cannot afford to have in-house CFO prefers to go with Virtual CFO. Organizations deal with many challenges on a daily basis in terms of financial aspects, growth, accounting as well as management. To curb those challenges, a need arises to appoint a Virtual CFO who can primarily be responsible for managing activities like financial reporting, record keeping and financial risks of the company. Presence of Virtual CFO helps in meeting those challenges effectively by giving financial and professional aid, analysis and support to the management.

Growing Face of Accounting

Accounting is experiencing some major changes in the process of its growth; number of firms has increased exponentially who are vying with each other. Small private companies currently have so much decision that standard service like tax preparation, bookkeeping, and compliance are turning out to be commoditised. There's so little differentiation in this packed market that it has affected the market value of these services.

Cloud technology is taking over accounting and is also reducing the basic value of accounting services. Firms who are eloquently using cloud technology to manage their finance and accounting department are more productive and efficient.