Import Export Code (IEC) Registration

IEC Registration is a compulsory requirement for carrying out a business of import or export of goods or services.

What is IEC?

When is IEC Needed?

When is IEC is Not Needed?

Benefits of IEC Registration

Documents Required for IEC Registration

Process of IEC Registration

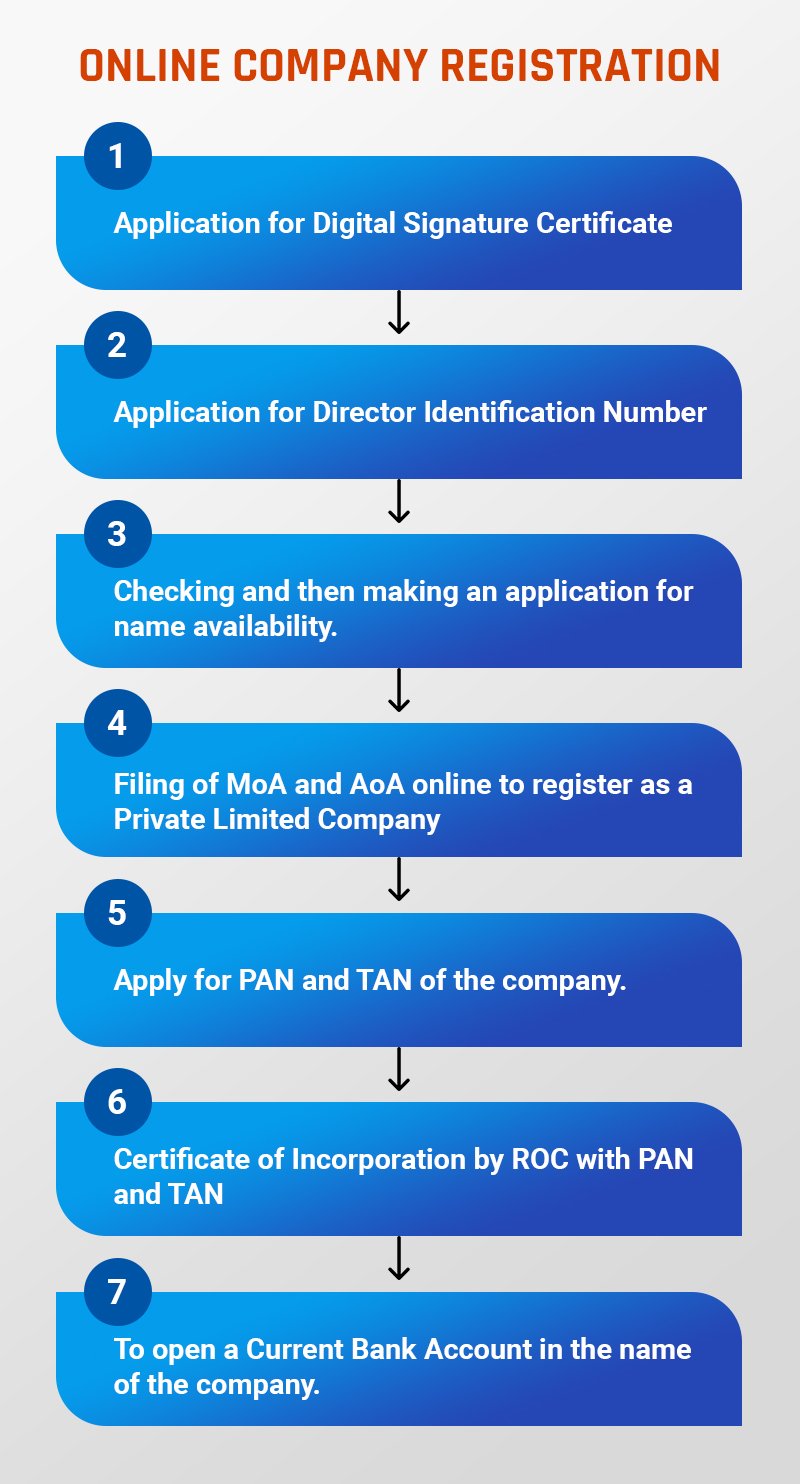

Overview of Private Limited Company Registration

A Private Limited Company is a privately maintained small business existence, which is one of the highly recommended means to start a business in India. The Companies Act 2013 governs private limited company registration in India.

While, minimum 2 shareholders are required to start a private company, while the higher limit of members are 200 as per the Companies Act, 2013. If a private limited company faces financial risk, its shareholders are not subject to sell their personal assets, i.e. they ought to have limited liability.

- A registered private limited company increases the credibility of your business. A registered private limited company increases the credibility of your business. A registered private limited company increases the credibility of your business.

- Help owners from personal liability and protects from other risks and losses.

- Draws more customers

- Ease in obtaining bank credits

- Offers limited liability to preserve your company’s assets

- Greater funds supplement and more attractive stability

- Enhance the potential to grow big and expand

Starting a private limited company offers many advantages. Some of them are as follows:

- Limited Liability

- The responsibility of the members of a private limited company is restricted to their share only as the private limited company is a separate legal entity.

- Separate Legal entity

- A private limited company is a separate legal entity which posses all the rights to sue or to be sued. It acts an artificial person which can buy a property on its own name.

| # | First | Last | Handle |

|---|---|---|---|

| 1 | Mark | Otto | @mdo |

| 2 | Jacob | Thornton | @fat |

| 3 | Larry | the Bird |

FAQs