Overview of Nidhi Company Compliance

Nidhi company is a kind of Non-Banking Financial Company aka NBFC. Because of the benefits Nidhi Company offers it is also called as Mutual Benefit Finance Company. Like every company, Nidhi Company also consists of few annual compliance popularly known as Nidhi Company Compliances. The statutory compliances related to Nidhi Company are disclosed in Nidhi Rules 2014 and the Companies Act 2013.

Provisions of the Section 406(1) of the Companies Act, 2013 defines the Nidhi Company as “A company which has been incorporated as a Nidhi with the object of cultivating the habit of thrift and savings amongst its members, receiving deposits from, and lending to, its members only for their mutual benefit.”

Nidhi Company is the perfect choice for those who want to indulge in lending business with minimum fund investment.

Nidhi Company Compliances Requirement

- Compliances help in forming exact insights about the company’s working performance.

- It is necessary for every company which is registered under the Companies Act 2013 to file for the compliances.

- Moreover Nidhi Company falls under the category of public company hence in order to protect the interest of its stakeholders it becomes compulsory for the Nidhi Company to follow the compliances.

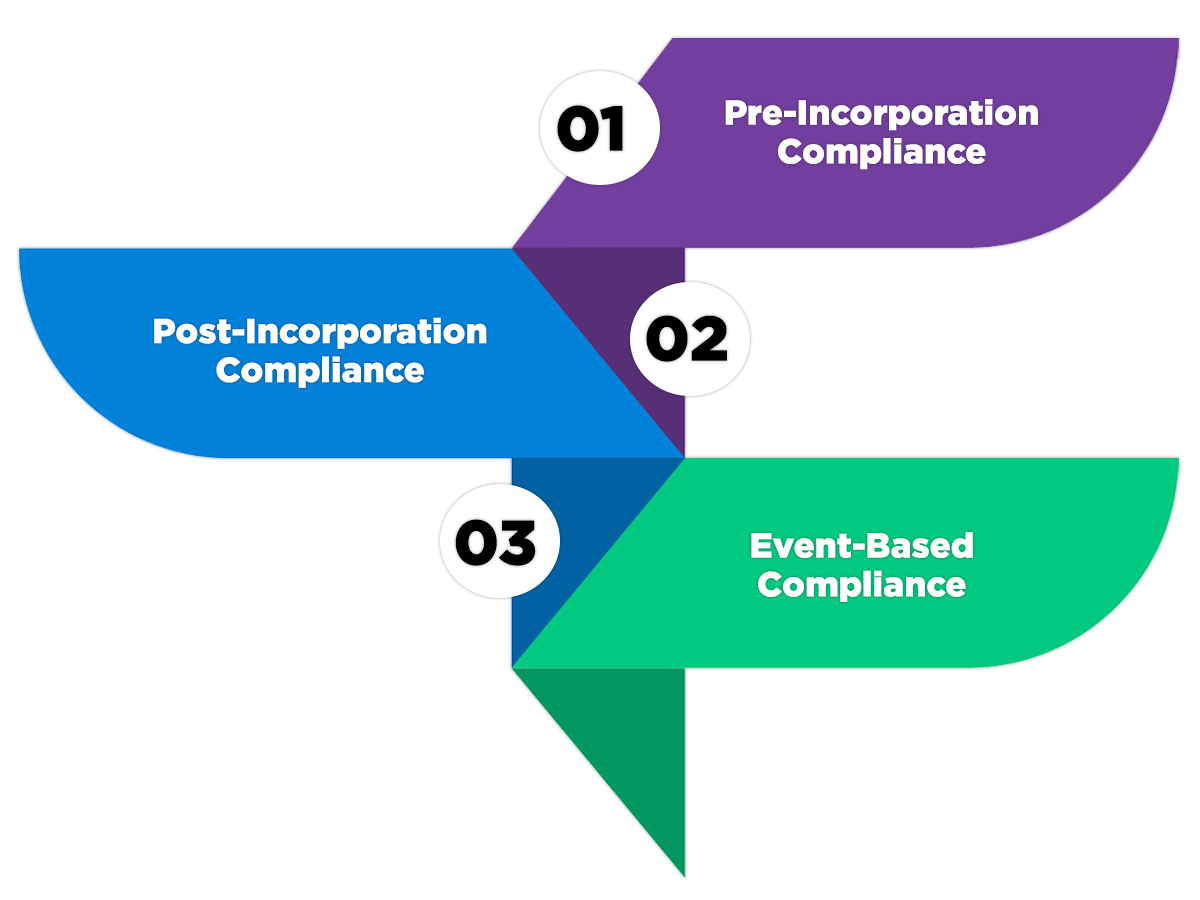

Nidhi Company Compliance Categories

Benefits of Nidhi Company Registration

- Easy Formation

1. A total of 7 persons where 3 will be appointed as Director can form a Nidhi Company

2. Hassle free registration process

3. Will take 10-15 days to register

- Cost Efficient Registration

Rs 5,00,000 is the minimum capital requirement for registration of Nidhi Company. The company also provide the opportunity to invest the capital within 2months once the registration is done.

- No RBI Regulations

Though Nidhi Company falls under the criteria of NBFC but they do not need any approval from RBI. Nidhi Rules, 2014 are drafted for such companies to regulate their activities and working performance.

- High level of certainty in Nidhi Company

The primary motive of Nidhi Company is to boost the habit of savings amongst its member. Hence, Nidhi Company can be counted as long term investment as its members will not stop savings anytime.

- Less level of Risk

The level of risk involved in the Nidhi Company is minimal due to its nature of accepting deposit and providing loans to its members as stated in Nidhi Rules 2014. It is a trust worthy and secured way of granting loan also loans provided to members are at a very less rate.